Australian Construction Industry Outlook – Q4 2024

Snapshot

The Australian construction industry in Q4 2024 continues to navigate a challenging landscape shaped by global trade tensions, monetary policy shifts, and currency fluctuations. Key trends include:

Trade tensions, monetary policy shifts, and currency fluctuations are impacting the Australian Construction market.

-

- Material prices stabilise from higher prior periods.

- Construction Costs still remain escalated.

- Insolvencies remain exceptionally high.

- Labour pressures persist for a series of reasons, including an ageing workforce and shortages in specialist trades.

- Category shifts – Data centres are rapidly growing, and the rise of prefabricated construction.

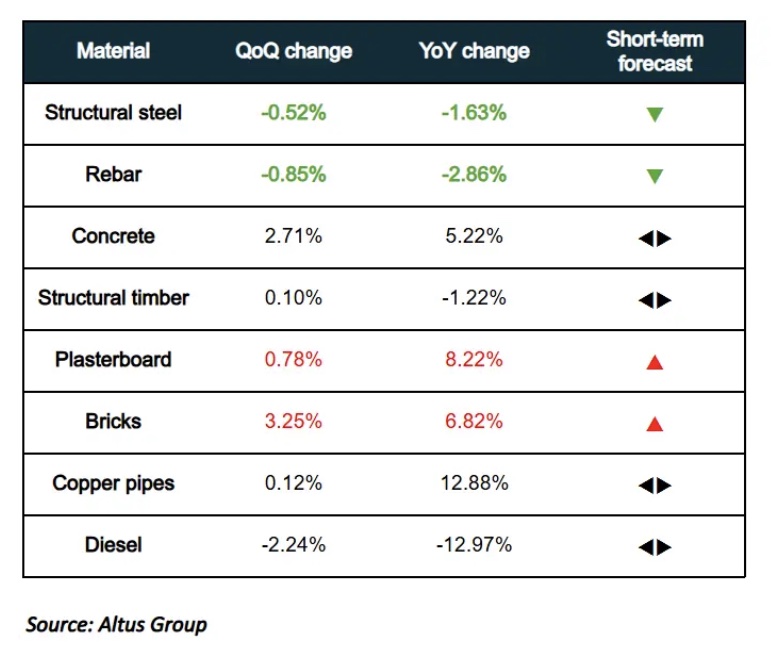

Australian Construction Material Price Trends – Q4 2024

Energy-intensive materials like concrete and bricks are experiencing ongoing price increases, while imported materials from China have declined, easing costs for builders sourcing internationally.

Energy-intensive materials, such as concrete and bricks, continue to increase in price, while imported materials from China continue to decline, offering some relief for builders sourcing international products.

Structural steel and rebar: Steel trading prices have fallen with weakening demand.

Structural timber: Australia’s housing construction slowdown and high inventory levels have kept timber prices relatively stable, with minimal volatility anticipated.

Plasterboard: Plasterboard prices have levelled off this quarter after a significant increase over the year. With demand remaining weak, no further price hikes are anticipated.

Bricks: Brick prices increased this quarter and annually. Surging energy costs have driven brick manufacturing cost hikes, as brick kilns are reliant on natural gas and transport costs. Furthermore, brick production is labour-intensive.

Copper: Copper prices have stabilised this quarter after a period of significant growth.

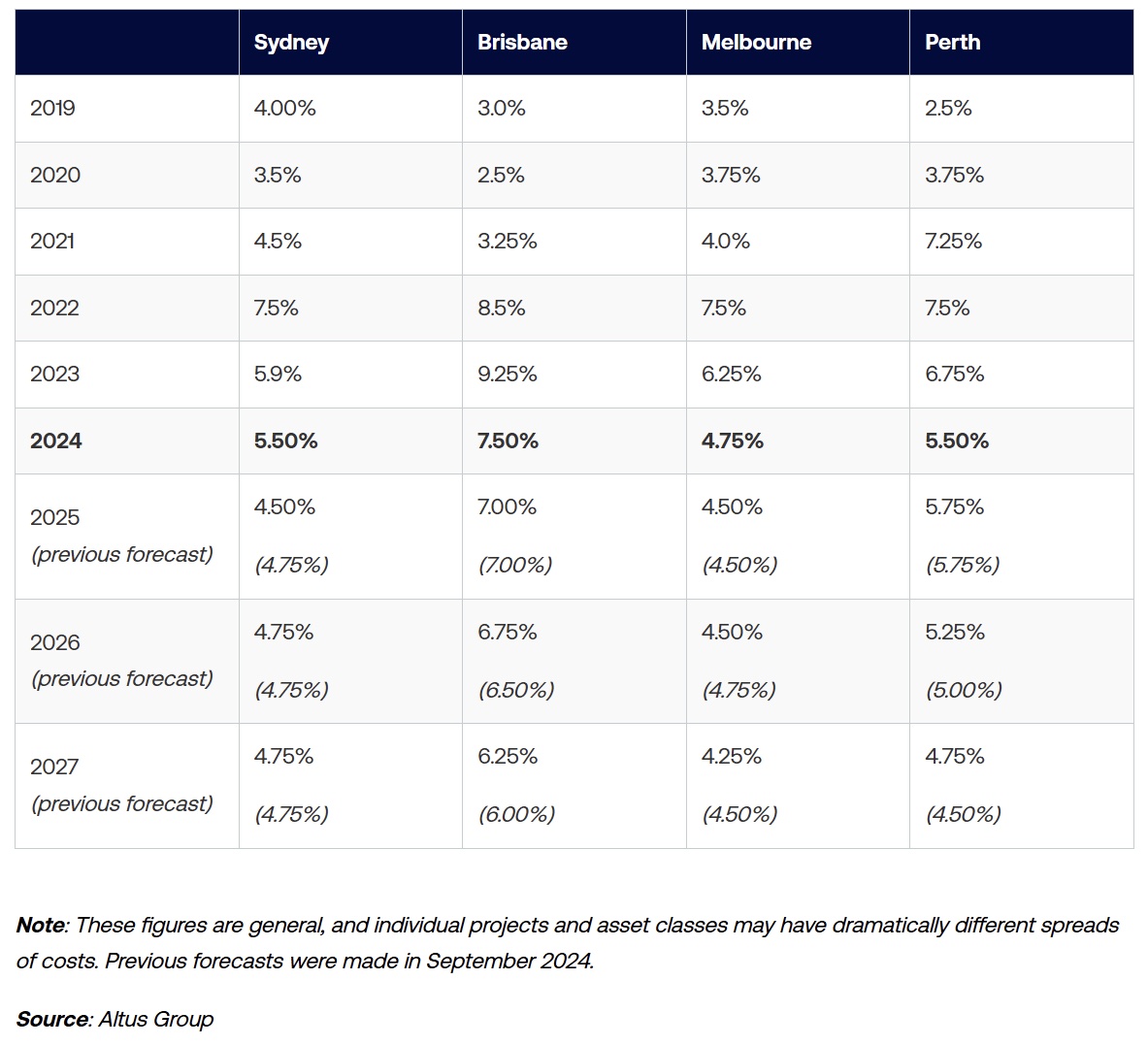

Key Construction Cost Escalation & Forecast

-

Queensland: Construction costs remain under pressure, driven by the 2032 Brisbane Olympics deadline and ongoing recovery efforts from recent natural disasters.

-

Sydney, Melbourne, Perth: Although construction costs in Sydney, Melbourne and Perth have lessened, they still remain relatively high for the foreseeable future.

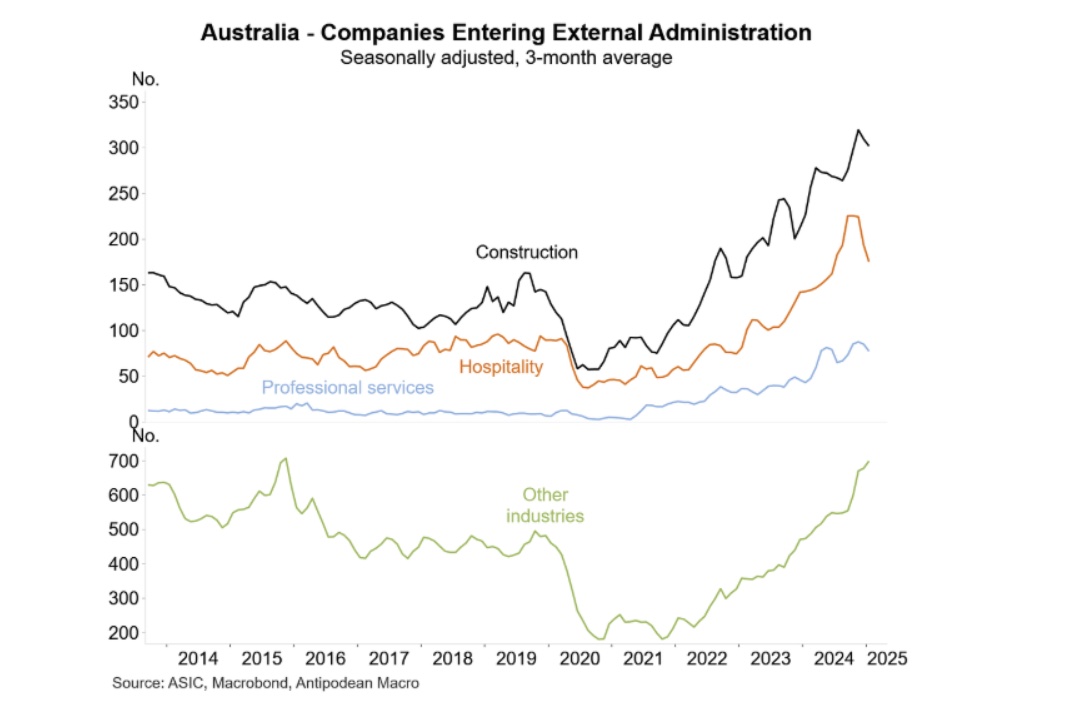

Insolvency Trends in the Construction Industry

Insolvencies remain on the rise, with 2024/25 showing a continued upward trend across the construction sector.

Smaller firms and contractors, in particular, are struggling to absorb escalating material and labour costs, leading to a higher rate of business failures.

Australian Construction Labour Market – Q4 2024

The sector faces severe skilled labour shortages, pushing up costs and causing project delays.

The Australian construction industry is facing significant labour pressures due to a shortage of skilled workers and increased demand, particularly in the commercial sector. This is leading to higher labour costs, project delays, and increased stress for workers. The issue is compounded by an aging workforce and a lack of younger workers entering the trades.

In March 2024, BuildSkills Australia reported that 90,000 new tradespeople would be needed by the end of the year.

Sector Category Growth – Two Categories Forecasted to Grow Significantly Over the Next Five Years.

Prefabrication/Modular Construction

Prefabrication, or modular construction, is experiencing significant growth in Australia, driven by factors like labour shortages, housing demand, and the potential for faster, more efficient construction. The market is projected to continue expanding. This growth is supported by government initiatives, research, and industry efforts to address the housing crisis and modernise construction practices.

The Australian Government has been convening a round table with prefabrication and modular construction representatives to discuss opportunities for growth during 2024.

Advances in modern manufacturing techniques applied to modular and prefab construction offer the potential to build housing more quickly and more cost-effectively.

Automation, robotics, precision design, and fabrication techniques can reduce the time needed to construct a high-quality home from a year to three months.

The government is eager to hear from the prefabrication and modular construction sector to identify trends, barriers, and opportunities for future growth and to help build more homes for Australians.

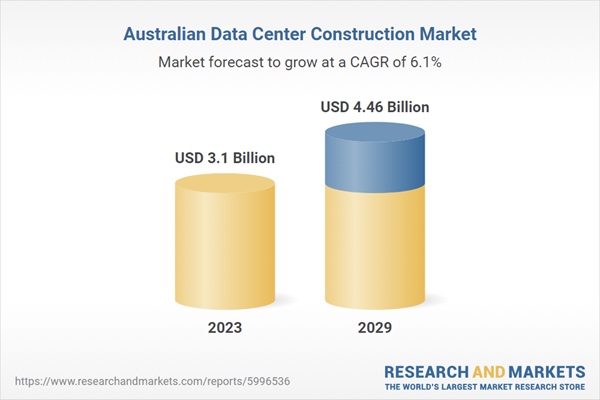

Data Centres

Rising demand for cloud services and digital infrastructure is fuelling a boom in data centre construction, offering new growth opportunities for the commercial construction sector.

Infinity Constructions: Your Trusted Partner Amid Industry Change

With over 33 years of experience and a portfolio exceeding 600 successful projects, Infinity Constructions is well-positioned to help clients navigate the complexities of the current market. As a Tier 2 commercial construction leader in Sydney and Melbourne, we offer:

-

Deep expertise across commercial, residential, aged care, industrial, and modular construction.

-

Proven strategies to manage material price volatility and labour challenges.

-

Innovative solutions for clients embracing modular and prefabricated building methods.

-

4.5-star Gold iCIRT rating and a focus on safety, quality, and sustainability.

Contact us today to learn how we can help deliver your next construction project efficiently and cost-effectively, even in a challenging market.

Frequently Asked Questions

What is the outlook for Australian construction costs in 2025?

Costs are expected to remain high but may stabilise in some sectors as material prices level off and modular construction adoption increases.

How are labour shortages impacting project timelines?

Shortages are causing delays and cost escalations. Builders like Infinity Constructions mitigate these risks with robust workforce planning and modern construction methods.

Is prefabricated construction a good option in 2025?

Yes, prefab is expanding rapidly due to its efficiency, cost-effectiveness, and potential to address labour shortages.

What sectors are driving growth in the Australian construction market?

Data centres and prefabricated housing are the fastest-growing sectors heading into 2025.